By the SandRose Editorial Team

It is no exaggeration to state that hydrocarbons have been one of the most pivotal materials in shaping the landscape of our world over the last century and a half. Hydrocarbon products have had a substantial impact on shaping the economic and political dynamics of the 21st century, and have contributed to the improvement of the quality of life globally on an immeasurable scale. While hydrocarbons have a very broad range of applications including the manufacture of consumer goods, power generation, and petrochemicals, few applications have as strong of an association with hydrocarbons as fuels for transportation.

As of 2022, figures indicate that the transportation sector (including road, aviation, and marine) accounts for just over half of oil energy demand by volume. In large developed economies such as the US, this figure lands at two thirds, which clearly indicates that this sector is a large component of global oil demand, particularly in developed nations.

With that being said, the industry and the world at large are undergoing a considerable shift in its energy mix, driven largely by policy changes and rapid advancements in technology. In this evolving landscape, it follows that the role of oil will shift along with this transition, which will undoubtedly have implications on the energy industry.

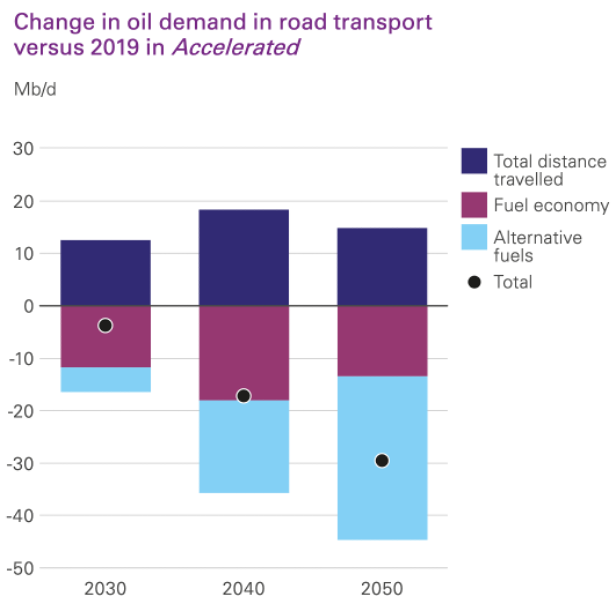

Change in oil demand in road transport versus 2019 in the Accelerated scenario (bp Energy Outlook 2023)

Figure 1

The figure above illustrates the estimated changes in oil demand in bp’s Accelerated (moderate) scenario, with the net change split into three primary components: total distance traveled, fuel economy, and alternative fuels – all of which are developments impacting the total oil demand within the road transport sector, which is predicted to steadily decline up to 2050.

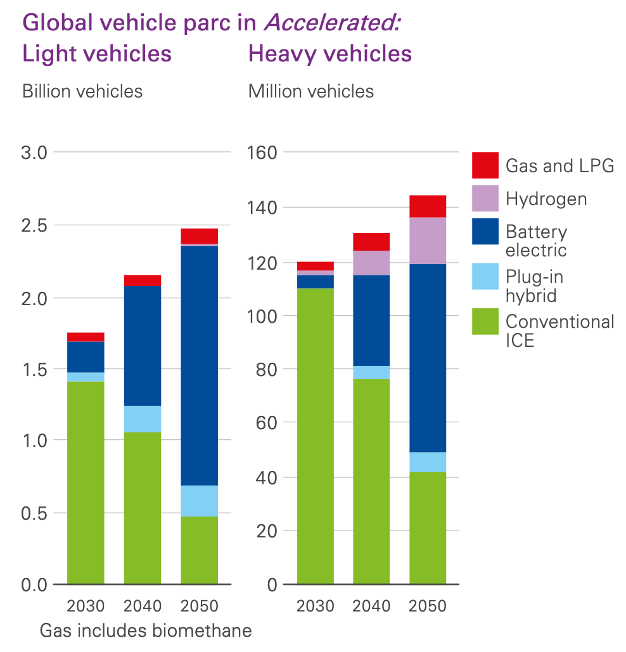

Another lens to consider is to analyze trends in the types of total vehicles on the road (known as vehicle parc) for both light and heavy vehicles. It is estimated that the internal combustion engine (ICE) will account for a steadily decreasing share of the vehicle parc, leading to a tipping point between 2040-2050 in which they may be overtaken by battery electric vehicles (EVs).

Share of estimated total vehicles on the road by type up to 2050 (bp Energy Outlook 2023)

Figure 2

While this shift in the proportion of oil demand for transportation will have implications for the industry, the nature of those implications requires some more nuanced investigation.

While this shift in the proportion of oil demand for transportation will have implications for the industry, the nature of those implications requires some more nuanced investigation. While some observers may see this decrease in demand as only a boon for renewables and electrification, the reality is that this proportion of demand is now freed up for reallocation towards petrochemicals and other industrial uses. For every barrel unburned in the transportation sector, another is gained for the production of plastics, electronic components, medicines, and a vast array of consumer goods.

This unfolds as the world’s burgeoning population is estimated to hurtle towards 9.7 billion people by 2050, with the largest growing socio-economic segment being the global middle-class. Expected to grow by approximately 2 billion people, this demographic segment will be the primary driver for increased demand for a wide variety of consumer goods that are derived from petrochemicals.

Expected to grow by approximately 2 billion people, this demographic segment will be the primary driver for increased demand for a wide variety of consumer goods that are derived from petrochemicals.

Despite a general trend of decreasing upstream investments globally, there are certain producers who are well-positioned to benefit from this market shift. The components of a successful and sustainable business model for producers will revolve around (a) having a fully-integrated product life-cycle from exploration to downstream, (b) low lifting costs, and (b) low upstream carbon intensity, further reinforced by rapidly developing carbon capture and sequestration technologies and initiatives.

We can now shift focus towards another key stakeholder in this equation: automotive manufacturers. Sustainability has now become a key objective for this market, reshaping priorities and propelling innovation. The Middle East, long associated with oil and gas reserves, is experiencing a considerable shift in its approach to mobility. In the Kingdom, ambitious plans within the transportation sector are taking shape, from mass mobility solutions such as the Riyadh Metro to more holistic forward-looking mobility blueprints in Neom.

In the Kingdom, ambitious plans within the transportation sector are taking shape, from mass mobility solutions such as the Riyadh Metro to more holistic forward-looking mobility blueprints in Neom.

Aiming to be the world’s first ‘zero carbon region’, this city of the future is slated to feature renewables-powered public transport solutions, an emphasis on cycling and walkability, as well as shared autonomous and electric vehicles – all connected to a wider network of domestic and international road, aviation, and marine transport networks.

Objectives under Neom’s plans for the future of mobility

Driven by the sustainability imperative, a growing emphasis on environmental responsibility reshapes priorities and propels innovation across the Middle East’s mobility landscape. This shift is particularly evident in evolving consumer behavior in the region, showing an increased focus on efficiency, electrification, and locally-sourced goods.

A recent survey by Bayt revealed that 78% of professionals in the UAE are willing to pay more for eco-friendly products and services. Such surveys indicate a surge in demand for electric vehicles (EVs), with the region witnessing a 40% increase in EV sales in 2023 compared to the previous year and a global stock surpassing 30 million in 2022, a 78% increase from 2020 (IEA, 2023). While still a minority of the total vehicles on road, EVs demand is still growing as a percentage of new car sales.

The Saudi Public Investment Fund is a majority owner of the US-based, Saudi-manufactured Lucid Air

Industry giants such as Saudi Aramco are no longer solely focused on black gold. With active investments in renewables, the company aims to diversify its portfolio while committing to net zero ambitions by 2050. Recently, Aramco has partnered with Electreon to develop wireless charging for highways, paving the way for a seamless transition to EVs in the region. Concurrently, the company is undergoing a substantial downstream expansion, with projects such as Crude-to-Chemicals aiming to convert 70-80% of each barrel to high-yield chemicals using cutting-edge integrated refining technologies.

Within the automotive sector, companies like Lucid Motors (in which PIF is a majority shareholder) are blazing a trail with luxury EVs boasting an impressive range of over 750 km on a single charge. Their commitment to sustainability extends beyond their vehicles; their state-of-the-art manufacturing facility in Saudi Arabia is powered by renewable energy, thereby minimizing their environmental impact. Elsewhere in this sector, Ceer vehicles are a promising new homegrown competitor in the automotive space, powered by well-established partners such as BMW and Foxconn.

The mobility sector’s journey towards sustainability is still in its early stages. As electric and hydrogen-powered vehicles expand their share of the market, other emerging technologies such as synthetic fuels and gasoline compression ignition (GCI) promise to keep ICE vehicles on the road for decades to come.

Saudi Arabia’s commitment to sustainability, vast resources, and strategic placement position it to become a global leader in the future of low and zero-emission mobility. By investing in innovation, fostering international and interdisciplinary collaboration, and empowering its citizens, the Kingdom is navigating the energy transition with purpose, paving the way for a bright future for the Middle East region as a whole. This pivot towards sustainable mobility is not just about changing vehicles; it’s about changing mindsets, embracing new solutions, and working together to build a more prosperous future.

This pivot towards sustainable mobility is not just about changing vehicles; it’s about changing mindsets, embracing new solutions, and working together to build a more prosperous future.

Looking ahead, the petroleum industry will be an instrumental global stakeholder in the future of mobility, and beyond.

Note to our readers: If you’d like to respond to the editorial with your own perspective, reach out to us at [email protected]